What is CAGR & How to Calculate It?

To increase our savings and get good returns on it, we have to invest in some means or the other. This instrument can be a mutual fund, bank FD or in the form of stock in the stock market. Before or after investing, we all want to know how much return we can get on the investment we are making. This return is usually expressed as a percentage, which is called Absolute Return, but if you track the returns of any mutual fund scheme, then the returns are shown in the form of CAGR. CAGR is an important ratio which helps us in calculating the average return of investments made at different times. In today’s article “CAGR meaning in Hindi” we will try to know about this ratio and also how it is calculated.

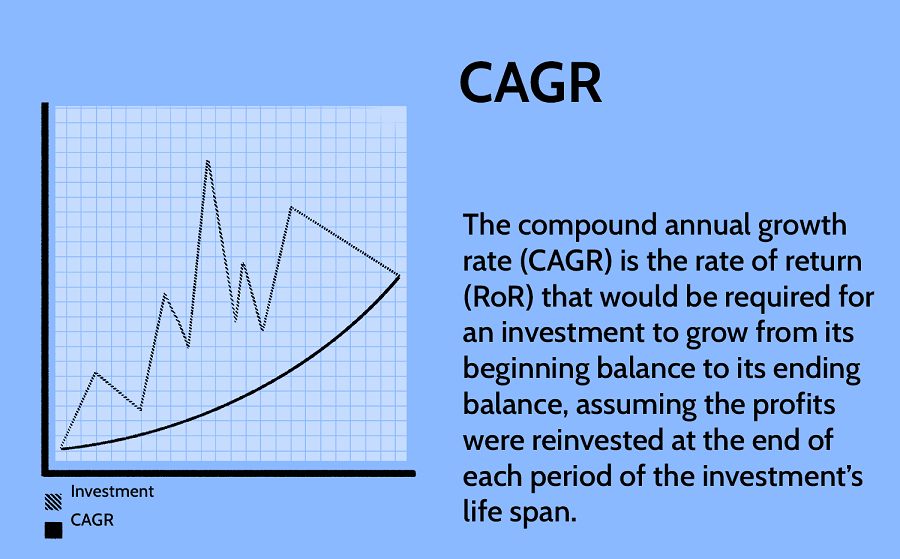

What is CAGR?

CAGR means: Compound Annual Growth Rate

CAGR helps in calculating the return or growth on the investment made by us in a given time period. In simple words, CAGR helps us to know how much return your investment has given annually after a certain period of time. This is one of the best ways to calculate compounding interest. Here your question would be that we can easily calculate investment return on the basis of increase in the amount invested, so what is the need of CAGR here. We understand the answer to this question through the example given below. Suppose you had invested Rs 1 lakh in a mutual fund scheme three years ago and today its value is Rs 1 lakh 20 thousand. Normally in this case it is said that the total return on your investment for three years is 20%, but the return of a mutual fund scheme is not fixed and it is not possible that the investment return is only 20% in all the three years. It is possible that you may have got 20% return in the first year, 7% in the second year and 30% in the third year. In such a case, we use CAGR to calculate the average return of three years. The return after CAGR calculation is 6.27%. This is the average return received every year for three years.

How does CAGR work?

CAGR is a useful tool that helps you calculate the average return each year based on the present value of your investments made at different points in time. Let us try to understand it with the help of the example given below: Suppose you had invested Rs 1 lakh in a mutual fund scheme 5 years ago and now its value has become Rs 1 lakh 50 thousand. According to simple return, we can say that the 5 annual return on our investment has been 50%, but from this return we do not know how much return we have received on our investment every year in the last five years because in mutual funds Returns are not guaranteed and returns on investment may vary from year to year depending on the performance of the scheme. Therefore in such a case we use CAGR and the return we get from it is 8.45%. That means the average return on your investment every year is 8.45% and not 50%.

How to calculate CAGR?

To calculate CAGR, we first need the figure which is our initial investment amount. After this, the value that we get by depositing the return on investment in the principal value, i.e. the present value of your investment. Thirdly, we have to keep in mind the time period i.e. the number of years for which the investment has been made. Once these three values are known, use the formula given below:

CAGR formula

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1

Suppose your principal investment amount is Rs 50,000

Present value of investment is Rs 100,000

Time period of investment is 7 years

CAGR will be formed according to this

CAGR = (100000 / 50000)^(1 / 7) – 1 = 10.41%

10.41% is the average percentage by which the value of your investment has increased every year. Microsoft Excel can be used to calculate CAGR. According to this, you can download the format of the formula from the link given below.

Benefits of CAGR

1. CAGR helps us in long term investment planning. It represents the average annual return of investment which helps us to know how a mutual fund has performed in different market conditions.

2. It is very easy to calculate CAGR. It can be easily calculated with the help of online tools and Microsoft Excel etc. Even if you do not have software available, you can easily calculate this return according to the formula.

3. With the help of CAGR, we can compare one mutual fund with another and it helps us in taking a right investment decision. CAGR helps us to know the risk associated with investment. If the CAGR of a mutual fund has been consistently positive, then it can be seen as a low risk and good growth investment option.

Disadvantages of CAGR – Disadvantages of CAGR

4. To calculate CAGR, two values are used, that is principal investment amount and present maturity amount. Due to the tenure of the investment and different market conditions, returns may face volatility which CAGR does not take into account.

5. It is mainly good for lumpsum investment. In the case of SIP investment where money is invested in fixed time intervals, this is not much of a prison.

6. CAGR is mostly used to calculate long term investment returns. It is not very useful in calculating returns for short term investments that involve large amounts in a short period of time.

7. In the calculation of CAGR, external factors like economic factors, interest rates etc. are not taken into account which can have a major impact on the performance of the investment.

Conclusion

CAGR is an important ratio in the financial world which helps us in calculating returns on investment and long term financial planning. Through this, we can compare different investment options and choose a good tool for better returns. But here it is important to keep in mind that CAGR also has some limitations like it works well only in long term returns and lumpsum investments. This is not very useful in the case of SIP because many investments are made regularly after a fixed time period. In short we can say that CAGR is a useful tool with the help of which we can calculate and analyze investment returns.